Oil and Gas Industry

Oil and gas is one of the most critical industries in the world and is a significant economic driver in the UAE. Oil is the world’s most important energy source, accounting for nearly two-thirds of global energy consumption. It is used in various applications, including transportation, industry, and manufacturing. Gas is also an essential energy source used in cooking, heating, and electricity generation applications. In the last decades, there have been several global incidents in the oil and gas industry. An article by Al Mazrouei et al., 2019, pp. 3216 shows that 30 employees work in the United Arab Emirates (UAE). Together, oil and gas are essential components of the global economy.

Established in 1971, the Abu Dhabi National Oil Company (ADNOC) is a wholly owned government entity. Nearly 95% of the UAE’s oil reserves are in Abu Dhabi, which also houses the company’s headquarters (Yedder, 2021, p. 212). When it comes to enhancing the skills of the local workers, ADNOC has adopted a long-term strategy. The UAE is, therefore, home to the Abu Dhabi National Oil Company (ADNOC), the largest oil and gas company in the Middle East, which is known to be the region with the lowest oil and gas production (Wang et al., 2021, p. 012113).

ADNOC is responsible for producing, refining, and marketing oil and gas and is a significant supplier to the global energy market. It is also responsible for raising its oil production by “several hundreds of thousands “ per day significantly (Paraskova, 2018). ADNOC works with international companies and partners to explore and develop oil and gas reserves and market and refine oil and gas products. ADNOC’s operations significantly contribute to the UAE’s economy, accounting for around 11 percent of the country’s GDP and providing employment for around 130,000 people.

UAE has a significantly high level of economic diversification among GCC countries and has taken several steps to diversify (Banafea & Ibnrubbian,2018, p. 43). In addition to its role as a major world producer and supplier of oil and gas, the UAE has also taken steps to develop a more diversified economy. This includes the development of renewable energy sources, such as solar and wind power, and introduction of progressive energy-efficiency policies. The UAE is also focusing on developing a robust knowledge-based economy, focusing on research and development in science, technology, and innovation.

The oil and gas industry is a hazardous environment that presents several risks to workers and the environment. These risks include fire, explosions, chemical spills, and environmental contamination. It is essential to address these hazards in order to ensure the safety of workers and the environment. The most significant hazards to address in the oil and gas industry include the following:

- Fire and explosions: Oil and gas operations involve highly flammable materials and combustible gases, which can lead to fires and explosions. This can result in severe injuries, fatalities, and damage to equipment and property. Three petroleum tankers explode in fire near ADNOC storage tanks in Abu Dhabi (Al Zaabi & Zamri, 2022, p. 14915). This poses a significant danger to the lives of humans in the region and the destruction of property.

- Chemical spills: Oil and gas operations involve using hazardous chemicals, posing a risk of spills and leakage. This can lead to the contamination of soil and water and the release of hazardous gases into the atmosphere.

- Environmental contamination: Oil and gas operations can lead to contamination of air, soil, and water, which can have severe impacts on human health and the environment.

- Worker safety: Every employee’s workplace safety and health are paramount in the ADNOC industry (Yaqoubi & Adnan, 2022). Oil and gas operations involve several potential risks to workers, such as slips and fall, exposure to hazardous chemicals, and working in confined spaces. Ensuring that workers are adequately trained and provided with the appropriate safety equipment to minimize these risks is essential.

In order to address the hazards in the oil and gas industry, it is essential to implement safety protocols, provide adequate training and safety equipment, and adhere to all applicable regulations. Companies should also develop and implement emergency response plans that include procedures for responding to fires and chemical spills. Additionally, companies should regularly inspect facilities and equipment to ensure compliance with safety standards. A questionnaire was used to collect data from 311 respondents working in ADNOC and showed a drastic improvement in risk management and employee performance in the UAE’s ADNOC National Petroleum Cooperation (Aljneibi et al.,2022, p. 4845). This is a positive remark.

Fire and explosions are physical hazards, as they release heat and pressure that can cause injury or damage to property. Chemical spills involve releasing hazardous chemicals into the environment, which can lead to soil and water contamination. Environmental contamination is an environmental hazard, as it involves the release of pollutants into the atmosphere or contaminating air, soil, or water.

Worker safety is an ergonomic, biological, and security hazard, as it involves potential risks to workers, such as slips and falls, exposure to hazardous chemicals, and working in confined spaces. Ensuring that workers are adequately trained and provided with the appropriate safety equipment to minimize these risks is essential.

In conclusion, the oil and gas industry is a significant economic force worldwide and in the UAE. It is essential to be aware of the potential hazards to which workers in this industry may be exposed and to take appropriate safety precautions. These hazards can be divided into six main categories: chemical, physical, ergonomic, biological, security, and environmental hazards. Workers should be aware of the potential for these hazards and take appropriate safety precautions.

Al Mazrouei, M. A., Khalid, K., Davidson, R., & Abdallah, S. (2019). Impact of organizational culture and perceived process safety in the UAE oil and gas industry. The Qualitative Report , 24 (12), 3215-3238.

Al Zaabi, S. H., & Zamri, R. (2022). Managing Security Threats through Touchless Security Technologies: An Overview of the Integration of Facial Recognition Technology in the UAE Oil and Gas Industry. Sustainability , 14 (22), 14915.

Aljneibi, M. M., Yahaya, S. N., & Husseini, S. A. (2022). Developing enterprise risk management model for employee performance within Abu Dhabi National Oil Company (ADNOC) in UAE. Journal of Positive School Psychology , 6 (3), 4845-4855.

Banafea, W., & Ibnrubbian, A. (2018). Assessment of economic diversification in Saudi Arabia through nine development plans. OPEC Energy Review , 42 (1), 42-54.

Paraskova. (2018, July 3). UAE’s ADNOC Can Lift Oil Production By ‘Several Hundred Thousand’ Bpd | OilPrice.com. OilPrice.com. Retrieved January 9, 2023, from https://oilprice.com/Latest-Energy-News/World-News/UAEs-ADNOC-Can-Lift-Oil-Production-By-Several-Hundred-Thousand-Bpd.html

Wang, K., Zou, Q., Wang, Z., Fang, L., & Jiang, W. (2021, February). Fiscal and tax terms and economic evaluation methods for oil and gas projects in Abu Dhabi. In IOP Conference Series: Earth and Environmental Science (Vol. 675, No. 1, p. 012113). IOP Publishing.

Yaqoubi, R. A., & Adnan, A. A. (2022). Ethical Leadership and Organizational Safety Performance in Abu Dhabi National Oil Company in the United Arab Emirates. Sch J Arts Humanit Soc Sci , 6 , 276-280.

Yedder, M. B. (2021). The Emiratization Policy in Abu Dhabi National Oil Company (ADNOC). International HRM and Development in Emerging Market Multinationals (pp. 212-232). Routledge.

Cite This Work

To export a reference to this article please select a referencing style below:

Related Essays

Reflective learning and entrepreneurship, waste reduction project measurement and critical-to-quality analysis, importance of effective clinical leadership in pre-hospital care through leadership styles, daycare wonders financial modeling, risk report outline, the mediated experience of live events and emotional connection, popular essay topics.

- American Dream

- Artificial Intelligence

- Black Lives Matter

- Bullying Essay

- Career Goals Essay

- Causes of the Civil War

- Child Abusing

- Civil Rights Movement

- Community Service

- Cultural Identity

- Cyber Bullying

- Death Penalty

- Depression Essay

- Domestic Violence

- Freedom of Speech

- Global Warming

- Gun Control

- Human Trafficking

- I Believe Essay

- Immigration

- Importance of Education

- Israel and Palestine Conflict

- Leadership Essay

- Legalizing Marijuanas

- Mental Health

- National Honor Society

- Police Brutality

- Pollution Essay

- Racism Essay

- Romeo and Juliet

- Same Sex Marriages

- Social Media

- The Great Gatsby

- The Yellow Wallpaper

- Time Management

- To Kill a Mockingbird

- Violent Video Games

- What Makes You Unique

- Why I Want to Be a Nurse

- Send us an e-mail

- Paper Writer Free >

- Essays Examples >

- Essay Topics >

Free Essay About Oil And Gas Industry

Type of paper: Essay

Topic: Oil , Industry , Gas , Energy , Supply Chain , Company , Power , Market

Published: 2020/10/15

This paper is aimed at analyzing the global energy industry with a focus on oil and gas segment using a Porter Five Forces framework. The oil and gas industry has many subsegments and a variety of products, but some level of generalization can be applied to describe the market within this framework.

Diagram of Porter’s Five Forces for the Industry

Barriers to Entry The oil and gas industry is very attractive in terms of profitability (Aubert & Frigstad, 2007), but the barriers to entry are high. The major global oil and gas market players are mostly integrated international companies that benefit from economies of scale. To enter this capital intensive industry, very high up-front investments and advanced technical knowledge are required for developing new oil fields or setting up facilities for production, amounting up to billions of dollars (Talevski & de Lima, 2009.) Other entry barriers are the following: governmental regulatory environemnt, asset specificity due to mineral rights acquisition necessity, the need for qualified labor with industry-specific skills, and also high level of risk due to physical hazard (Faulkner, 2011.) Patents on technologies drive differentiation in the industry as well as cost reduction, and act as entry barriers, but in refining, where technology is widely familiar, the impact of technology patent barriers is less than in other subsegments. The threat of entry of new competitors is relatively low, but it’s necessary to mention that in this industry the companies can operate at a specific part of the supply chain not covering the other chains (Datamonitor, 2010.)

Intensity of Rivalry

As many of oil and gas companies are large multinational businesses carrying out a wide range of activities including extraction, refining, manufacturing and marketing of petroleum products, power generation, etc., the level of concentration at the market is high. There was a number of large mergers in the oil and gas industry globally within the past two decades (for example, selling the BP shares by the UK government; BP acquisitions of such companies as US Standard Oil Company or Amoco), which resulted in higher market concentration ratio (Mahajan, 2006.) So, situation in the oil and gas industry is characterized with the high level of competitive rivalry between existing players (for example, Exxon Mobil, Shell, British Petroleu lacking differentiation. The exit barriers in the industry are high. The growth rate of the industry is relatively low – according to BP Energy Outlook 2035, the global energy demand is expected to increase by 1.5% a year by 2035 (BP, 2014.)

Supplier Power

For the large vertically integrated market players, such as BP or Shell, all processes and materials flow of the value chain, from raw materials to customer, are covered by the company (De Raad, 2014.). But, in addition to that “internal supplies”, oil and gas giants have a complex and diverse chain of suppliers. Countries rich with natural resources like oil and gas can be considered as resource suppliers for the industry. The powerful suppliers can affect the industry landscape through increasing prices, limiting output or integrating efforts. In the 1970s, embargos by the oil producing countries pushed oil prices upwards; it’s an obvious evidence of suppliers’ power (Talevski & de Lima, 2009.) Also, oil and gas industry needs specific equipment and services from the providers like Baker Hughes, Haliburton, Shlumberger, etc. These supplying companies are large and diversified with great bargaining power over the market (Datamonitor, 2010.) Prices for specialized equipment define the necessary volume of investment in drilling, exploration and production. But as the energy companies are also large and consolidated, and represent substantial buyers for those suppliers, it diminishes the bargaining power of supplier. So, talking about resource suppliers – oil-rich-countries, it can be seen that the suppliers’ power in this industry is rather high, the same situation is in specific equipment, in engineering, R&D and technology area, but in materials and service areas, with smaller and less consolidated suppliers, the power of suppliers are relatively less.

Buyer Power

As most of the oil and gas manufacturers producers also are integrated downstream through owning gas and petrol stations (Hokroh, 2014), we mean by buyers the final B2C and B2B consumers. Large institutional buyers (for example, chemical companies) with high volumes of purchases, can impact the oil and gas companies’ revenues (Datamonitor, 2010). But in general, the market of buyers, especially B2C buyers, is highly fragmented (Aubert & Frigstad, 2007,) so, their bargaining power is limited to medium level. However, in this area the brand loyalty is not very high; the customers can easily switch from one supplier to another.

Threat of Substitutes

According to the BP Energy Outlook 2035, within the next two decades the share of oil in energy consumption will decline slightly; “its position as the leading fuel briefly challenged by coal” (BP, 2014.) The share of gas is increasing. Challenged by growing renewable energy sources such as biofuels, still the fossil fuels are expected to remain the dominant energy sources with the share of 81% (BP, 2014.) So, traditional sources of energy are currently irreplaceable in the majority of industry sectors as well as in transportation. Of course, there’s a remarkable shift in the governments’ policy towards renewable and “green” energy; but the production costs for renewables are quite high as compared with petroleum products (Talevski & de Lima, 2009.). Many oil and gas giants are investing in research and development in the domain of alternative energy sources; so, to some extent, they control the trend towards “green energy”. So, the threat of substitutes can be considered as medium.

Oil and gas industry is dominated by large multinational companies with diversified structure. The competitive rivalry within the industry is rather high, because of “majority of companies are in the race to replace their drying oil resources” (Talevski & de Lima, 2009.) As the fossil energy sources are depleting gradually, it becomes more difficult to exploit existing or new fields, and it requires higher amounts of investments as well as sophisticated equipment and technologies. That’s why the entry barriers in the industry are high, and there’s a negative trend in the projected profitability. The dominating companies at this highly concentrated market control almost all the parts of the value chain, so some subdivisions can act as internal suppliers and buyers for others. But there’s still a diverse network of external suppliers. In some areas, such as complex specialized equipment, technology, raw materials, the bargaining power of suppliers is substantial, while in others (such as services) is relatively lower. The buyers’ market is made up with a large number of consumers with low brand loyalty and higher price sensitivity. The traditional sources of energy at current level of technologies are dominating and will remain prevalent in the nearest future, but the shift to renewables and “green energy” shouldn’t be underestimated. The oil and gas giants try to control the trend, supporting and funding innovation in the energy sector.

Works cited

BP, 2014. BP Energy Outlook 2035. Web. Accessed 16 January, 2015. Retrieved from http://www.bp.com/content/dam/bp/pdf/Energy-economics/Energy-Outlook/Energy_Outlook_2035_booklet.pdf Hokroh, M.A., 2014. An Analysis of the Oil and Gas Industry’s Competitiveness Using Porter’s Five Forces Framework. Global Journal of Commerce & Management Perspective. March-April 2014. Vol.3 (2):76-82. Retrieved from http://www.gifre.org/admin/papers/gjcmp/PORTER%E2%80%99S-vol-3-2-gjcmp14222.pdf Talevski, D. & de Lima, A.D.L. , 2009. Strategic and Financial Analysis in the Oil Industry: Petrobras Shareholders Value Potential and Fair Value of Stock. Retrieved from http://pure.au.dk/portal/files/8058/M.THESIS.pdf Datamonitor, 2010. Oil and Gas in North America. Industry profile. Retrieved from http://www.slideshare.net/ChevronBrandValuation/oil-and-gas-in-nth-america-industry-profile Faulkner, Ch., 2011. The Future of the Oil and Gas Industry. Retrieved from http://www.breitlingenergy.com/wp-content/uploads/2011/06/The-Future-of-the-Oil-and-Gas-Industry.pdf De Raad, J., 2014. The future of international oil and gas extraction firms. Retrieved from http://projekter.aau.dk/projekter/files/198575273/MSc._Thesis_Joek_de_Raad_The_future_of_international_oil_and_gas_extraction_firms_The_drill_into_competition_and_internationalization_strategies_6th_June_2014.pdf Aubert, A.E. & Frigstad, A.K., 2007. Strategic analysis of Statoil’s international competitiveness. Retrieved from http://brage.bibsys.no/xmlui/bitstream/handle/11250/169137/Aubert%20og%20Frigstad%202007.pdf?sequence=1 BP SWOT & Five Forces Analysis Following Implications of It. Retrieved from https://sadikn.wordpress.com/2013/12/11/bp-swot-five-forces-analysis-following-implications-of-isit/ SWOT and Porter Five Forces Analysis of Royal Dutch Shell. Retrieved from http://writepass.com/journal/2013/01/swot-and-porter-five-forces-analysis-of-royal-dutch-shell-plc/ Mahajan, S., 2006. Concentration ratios for businesses by industry in 2004. Economic Trends 635 October 2006

Share with friends using:

- Accounting Principle Essays

- Example Of How Internal And External Factors Affect The Four Functions Of Management Critical Thinking

- Moral Legacy Essay Sample

- Good Example Of Report On Long Term Investment Decisions

- Free Cultural Norms Fair Lovely And Advertising Case Study Sample

- New Deal Programs Essays Example

- Why Have Personal Navigation Devices Become Popular What Technologies Are Required To Facilitate The Success Of Pnds Case Study Sample

- Good Example Of Foundations Of Modern Day Management Theory Essay

- The Reaction Of Book 15 Chapter 15 Of Homers Iliad Book Review Example

- Sample Essay On Continuous Development Of Alternative Energy

- Research Paper On Hepatitis

- Example Of Essay On Lack Of Bme Professors In Higher Education

- Free Essay On The Debate On Global Warming

- Free Case Study About What Was Wrong With Mr Mains Approach In Gathering Data

- Good Marriage And Repression In Chopins The Storm And The Story Of An Hour Essay Example

- Essay On Parenting

- Geography Essay

- Critical Thinking On The Evidences Of The Evils Of Neo Colonialism

- Good Example Of Business Plan On Create An International Marketing Plan For The Organization

- Essay On Comparing And Contrasting Greek And Roman Cultures

- Good Movie Review About The Mysteries Of The Brain

- Example Of Term Paper On Homeland Security

- Good Scottish Educational Policy Critical Thinking Example

- Sample Report On Exploring Ethics

- Free Case Study On Mission Statement

- Free The Synthesis Essay Sample

- Free Essay On Garment Labels

- Example Of Segmentation Research Proposal

- Good Example Of Two Month Summer Vacation For Students Is Too Long Essay

- Free Research Paper About Employment At Will Employees Essence And Execution

- Small Business Proposal Essay Sample

- Example Of Chiba International Assignment Essay

- Example Of Essay On A Discussion Of Research Principles And Applications In Human Resource Research

- Cryptosporidium Parvum Report

- Free Role Model Beyonce Knowles Research Paper Example

- Effects Of Technology On Healthcare Essay

- Usage Of The Internet Can Lead To Mental Health Problems Essay

- Criminal Procedure Essays Examples

- Free Effects Of Medication With Children And Fractures Essay Example

- Free Essay On The Views On Modern Art

- Essay On Revision Of Draft 2

- Good Example Of The Following Part Of External And Internal Corporate Governance Resulted To The Failure Of Enron Case Study

- Treatment Of Ventilator Associated Pneumonia Research Papers Example

- Ethical Research Guidelines For The Research Essay Samples

- Good Example Of Shinning Stars And Business Evolutions Comparing The Lives Of Jp Morgan And Mary Pickford Essay

- Gf Craft Organic Gluten Free Cuisine Essays Example

We use cookies to improve your experience with our site. Please accept before continuing or read our cookie policy here .

Wait, have you seen our prices?

Oil and Gas Industry: Extensive View Essay

Introduction, uwi explanation and project location, analysis and results, converting optimization, minimize the operation cost (opex), recommendations.

The oil and gas industry is a very broad industry where many different sectors and engineers complement one another in order to deliver the most efficient performance. By referring to the performance, it means the operation system tracked by the production capacity of the company. Indeed, during performance safety remains as the leading priority. Several techniques and methodologies are used to increase the operation capability. In the production stage, a good number of such techniques are related to certain mechanical systems known as the artificial lift. However, the artificial lift appears in several types and play different roles in regard to the type and conditions of the well. Actually, these may include the pump jack and the plunger lift.

This report aims to illustrate how to optimize the wells that involve a plunger lift through converting its measurement system from analog to digital. In order to do that one ought to justify whether installing the electronic measurement system is profitable or not for the future of the company. This is palpable by running an economic case and meets the regulations in all cases. Subsequently, this would make it easy to demonstrate to the Company’s upper management whether the conversion is feasible for the rest of the 28 wells. It also becomes possible to advice the company to remain with the current analog system in anticipation of extra studies and proper optimization is accomplished.

Methodology

The justification of this conversion will be determined via choosing three wells for testing purposes. These wells must be initially visited in order to install the new measurement system to enable optimization upon them. At that point access to the production data and figures of such wells as well as the other software tends to assist in employing the changes. Access may be done through the main office other than visiting the field for each stage of the project. In case of any immediate needed changes, the proactive interaction with the field technicians will take place.

TAQA is the sixth global energy company that has operations in nearly eleven countries around the world. Every branch of TAQA has a specific sector of energy investment depending on the country of investment, distinctions, and needs. TAQA NORTH is subsidiary company that caters for the operations in North America. The subsidiary company covers the provinces of Alberta, Saskatchewan, and British Columbia in Canada. The Company adapts to oil and gas exploration in Canada. The project is done by joining the development department in the area of Eastern Alberta particularly Central Mature team. Each team involves at least a geologist, geophysicist, a production engineer, an exploitation engineer, as well as an asset manager. In this case the asset manager is the leader of the team and also the direct supervisor. Every single member of the team has his/her own role that adds a significant value to any project.

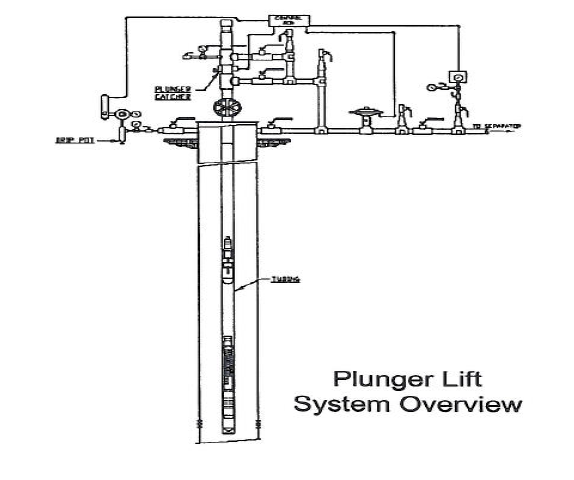

Plunger lift

Plunger lift (figure 1) is an artificial lift type. It is a tool that is specifically used in the gas wells as a long-term solution in a specific circumstance that occurs in the gas well. Initially, the gas well produces normally. By the time the vapor water flows with the gas upwards, it is condensed at the tubing wall. Afterwards, it falls back and accumulates at the bottom of the tube. Subsequently, the increment of fluid volume at the bottom enables the gas flows to become dilatory until it stops flowing towards the wellhead.

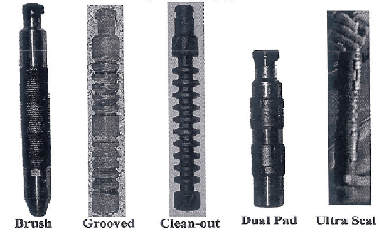

The plunger lift removes all the liquids from the bottom of the tube and allows the gas to flow normally again (Dan, Lynn & Gordon, 2005). Therefore, it is a tool that raises the well’s productivity in the long term. There are many types of the plunger lifts such as the brush, cleanout, ultra seal, soldering, and dual pad as demonstrated in figure 2. There are various factors that possess direct effect on the velocity of the falling trip of the plunger. These include the age, diameter, friction with tubing, and the plunger-tubing seal effect. Different operators usually have different preferences for the types of plunger lift in regard to their diverse manufacturing features. For instance, different types may be made of a solid piece or multipart with wide or thin diameter to determine the efficiency that is manifested by its capability for water removal.

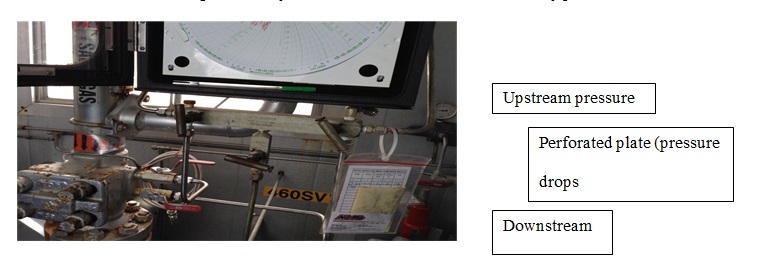

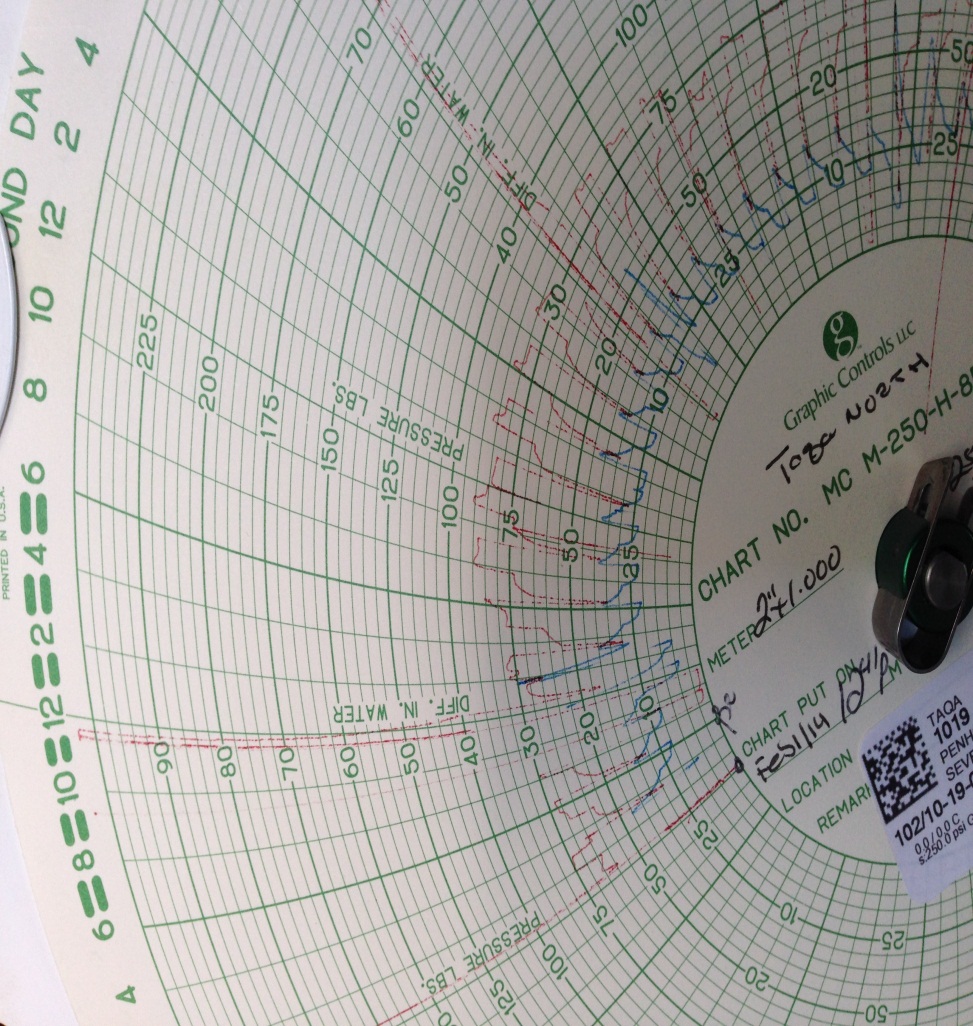

Analog (Chart systems)

There are several methods for measuring the plunger lift mechanism and adjusting its movement. Linking the measurements system to a controller sitting is the most significant factor in determining the performance of the plunger lift and subsequently the gas well productivity. The measurement system that is used currently is called the chart system (Dan, Lynn & Gordon, 2005). The system as in figure 4 is a circular chart paper working as an analog system that records the data for the production and flow rate. Similarly, the system provides some measurements like tubing pressure, casing pressure, and temperature. The manner in which the chart system works determines the gas flows to the lubricator. The flow passes through a region containing upstream and downstream tubes with sensors as illustrated in figure 3. In between, there is a plate with a hole in the middle. When the flow passes, the upstream sensor records the first pressure before that pressure drops as it passes through the hole. In contrast, the downstream sensor records the second or differential pressure that determines the flow rate. In addition, both the sensors record the temperature. However, each sensor is connected to the chart through the small tubes that moves small pens which draw cycles on the chart (Dennison, 2013). This shows the after flow period, the loading period, as well as the shut on and shut off time. Nevertheless, there are some disadvantages of this system that is to be discussed in the body part into details.

Digital (SCADA systems)

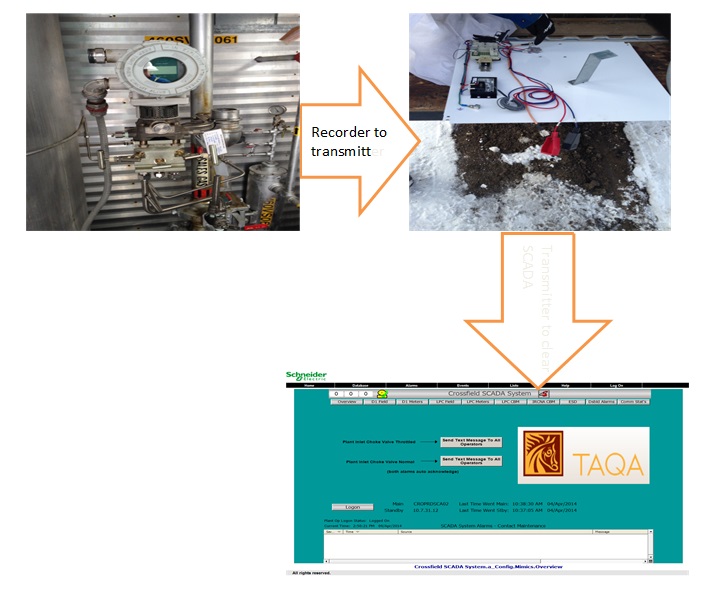

In order to optimize the work of plunger the engineers usually convert the measurement system into a more advanced digital system called supervisory control and data acquisition (SCADA) system. The SCADA is an automated measuring and controlling system for the industrial processes. It is an electronic flow measurement (EFM) type that is a specific controller and gives more advantages to the operation to be analyzed. The process of measurement goes through main stages based on the installation. The recorder machine does almost the chart job of recording the data automatically (Dennison, 2013). The transmitter machine on the other hand transfers these data via a wireless connection into the clear SCADA setting in the operator’s office as demonstrated in figure 5.

The UWI also named unique well identifier is a location identifier of the wells, facilities, lands, pipelines, pools, and roads in the province of Alberta. Based on UWI, the entire public data is recorded in all the oil and gas software. It consists of the township and a meridian intersection. The location is divided into 36 sections with each section involving 16 units. Hence, the determined and examined well locations in this project include 04-11-037-27W4M, 0-29-036-27W4M, and 20-036-27W4M. Basically, for the purpose of justifications, the software called Accumap aids in showing the specific mapping system as shown in figure 6.

Current state: Chart system

The chart system has some disadvantages that should be evaluated deeply. To start with, the chart system is an old measurements system that does not have the ability to control or adjust. A

ctually, it simply measures and keeps the data. Furthermore, it does not save the data for a long time. The problem results from the fact that most of the chart sheets have duration of one week maximum. Therefore, it requires a periodic follow up by the operator in order to record the data and check the operation. Supposed the gas is missing at the plant, the operator must make the adjustment in the plunger work manually (McManus, 2013). The system is accurate and the likelihood of human error in getting the data and measurements is slightly possible since scaling is very small as shown in figure 7. Hence, optimizing either the productivity or the efficiency of a plunger well is invalid in this method.

Maximize the production

The optimal production capacity gained out of the gas well is by optimizing the plunger setting in the controller. In order to achieve this, the usage of SCADA system is significant (MTRAC, n.d). Maximizing the production using SCADA mainly occurs through two important differences. Primarily, in the chart system it is noticeable that the line exceeds the chart range. This represents a loss in production as presented by the red line in figure 7. The situation always occurs at the beginning of each day’s cycle when the plunger starts to flow in (McManus, 2013). This problem is hard to fix while maintaining the chart system. Moreover, SCADA provides the ability to monitor and manage time of the loops per day, the velocity of the plunger lift, and the flow periods such as loading versus shut in durations. Ultimately, the system fixes the remaining process on a preferable state. The operator has to try different plunger cycle periods through shutting the plunger on and off for a better production. Besides, the operator ought to check the system using quicker and more loops that allow small buildup of fluids. The operator may also wait for the fluid to build up for a long time and let the plunger remove it via the use of slower and fewer plunger cycles. The mechanism eventually helps the technician to determine the proper number of hourly or daily loops. This allows the plunger and the well to perform effectively until the optimal production is reached (MTRAC, n.d.).

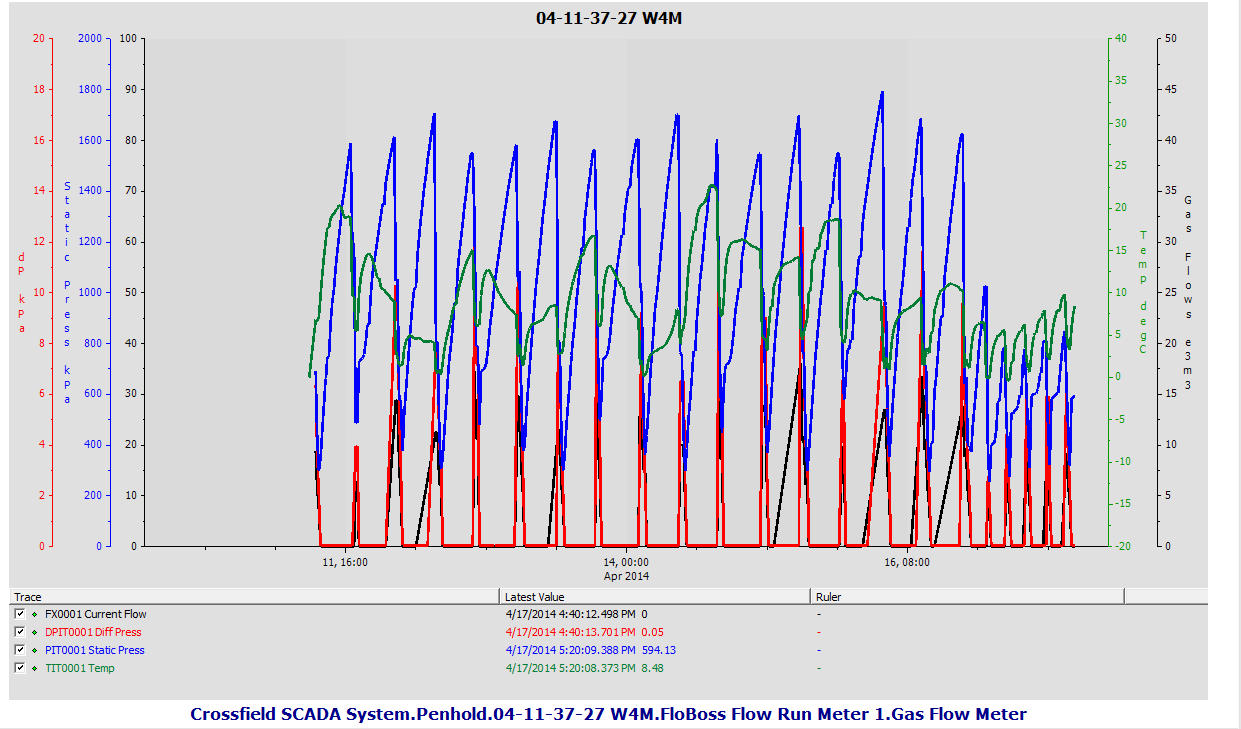

The cycles demonstrated in figure 8 shows that the periods are very similar to one another in that once the operator makes his adjustments, the plunger should perform in compliance with the regular sitting. Each cycle has two main stages, the flowing period that usually loads the liquid and the shut in period in which the well is not flowing while the BHP (bottom whole pressure) is building up.

In order to meet the optimization task, focus is laid on three main directions so as to come up with solid evidence on the incremental portion. At first, the past experience of the field operators maintains that SCADA system would have an approximate of 1 e3m3/day in average. They expect that the sustained uplift increases in the future as proved by other converted sites of the company in different areas. The second evidence is based on the case stating that any type of electronic measurement system increases the volume by 10 to 40% in consistency with the operator’s estimation. The third proof emerges in the installed SCADA system on the three wells under investigation. The fact is supported by the clear SCADA access to two of the three wells with the adjustments on such wells. In consequence, the production history of the two wells, period of SCADA installation, the kind of changes made, as well as the results achieved are revealed.

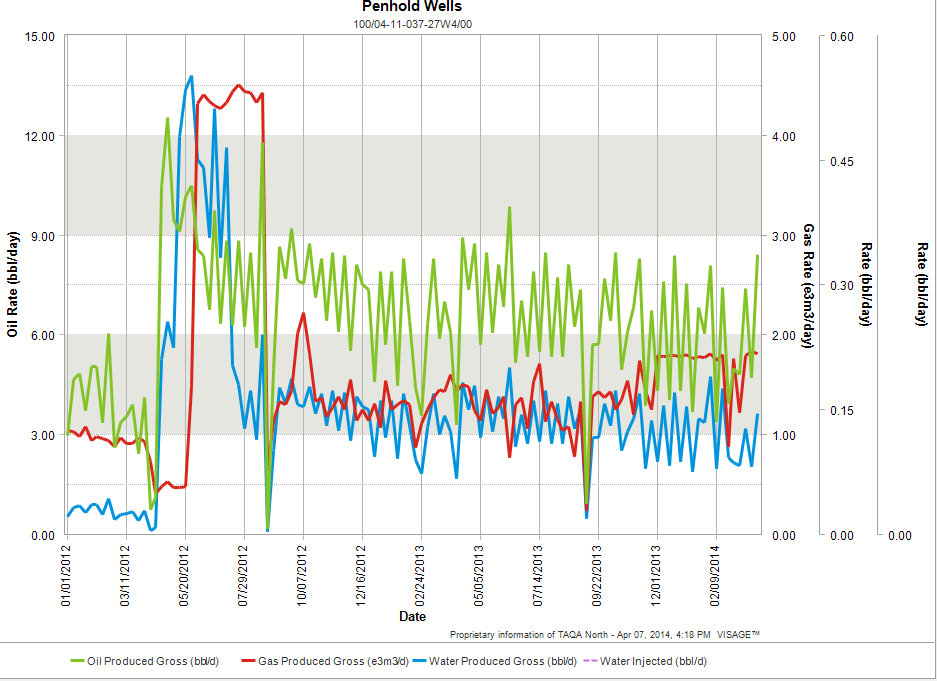

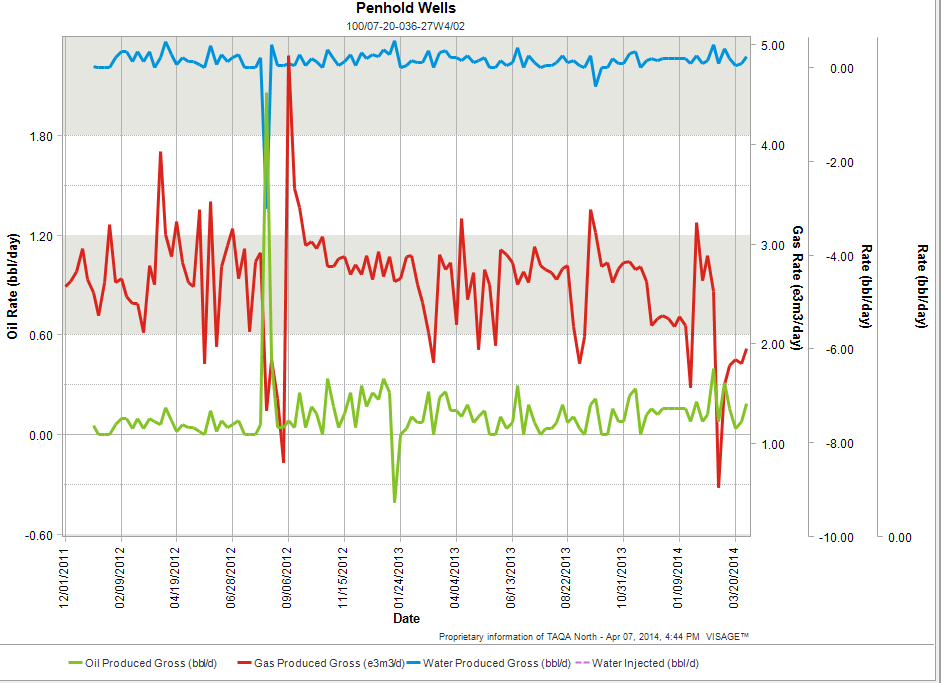

The plan (figure 9) shows the flow rate versus the time for the well which is 04-11-037-27W4M. The red, green, and blue lines represent gas, oil, and water respectively. The plunger lift was installed in June 2012. Therefore, in approximation it is possible to obtain a remarkable jump in the gas production from 1e3m3/day to 2e3m3/day. Similarly, the oil went from 2bbl/day to 2.5bbl/day. Under the same facility, water had an increase in volume. SCADA was installed right at the end of the period of April 2014. Yet, the volume increases due to SCADA optimization cannot be observed as a result of the fact that more time required. Nonetheless, certain developments have been done so far and it is apparent that clear SCADA might give some better results in the meantime.

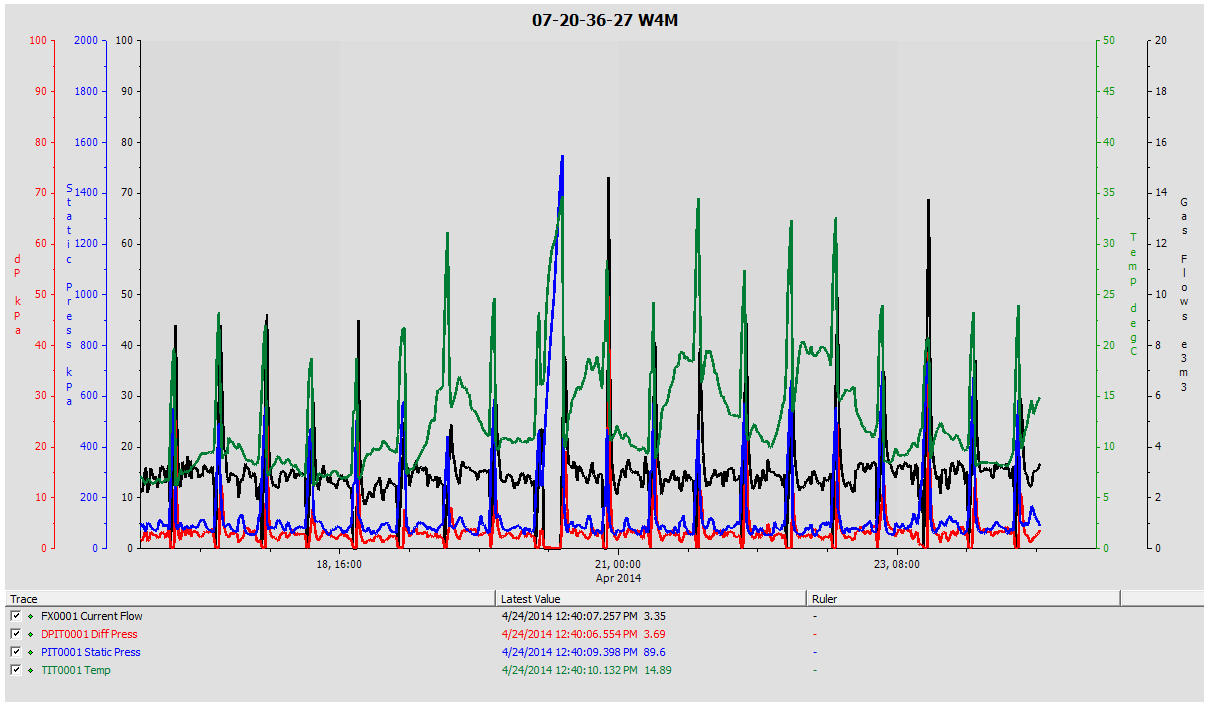

Four main components versus time are demonstrated in figure 10 to help in obtaining the result. The blue line represents the static pressure of the gas in the wellhead while the red line shows the differential pressure. In fact, the differential pressure is the most important in determining the flow rates of the gas illustrated in black line. Finally, the green line describes the behavior of temperature throughout the period.

As the graph shows the initial installation of SCADA, a cycle of seven hours shut in and one hour flow provides a total of three flowing hours per day. This is considered to be a very small flowing period. Accordingly, the arrow points at the first setting variation done by changing it into three hours for the shut in time with one flowing hour in each cycle. This allows for the raising of the flowing periods into 6 hours a day. The shut in time was not adjusted to more than three hours. It is due to the fact that it was necessary to originally check whether that time was sufficient for the well bottom to build up enough pressure. Similarly, this would enable the plunger to get to the surface. Supposed the plunger did not make it to the surface, it was possible to decide on the next adjustment to be applied. Obviously, a four shut-in hours and two flowing hours in each cycle would be applied. The adjustment would allow the bottom hovel gravity to build more pressure and have extra flowing periods of eight hours per day. Unfortunately, due to the limited time the adjustment result was not shown appropriately.

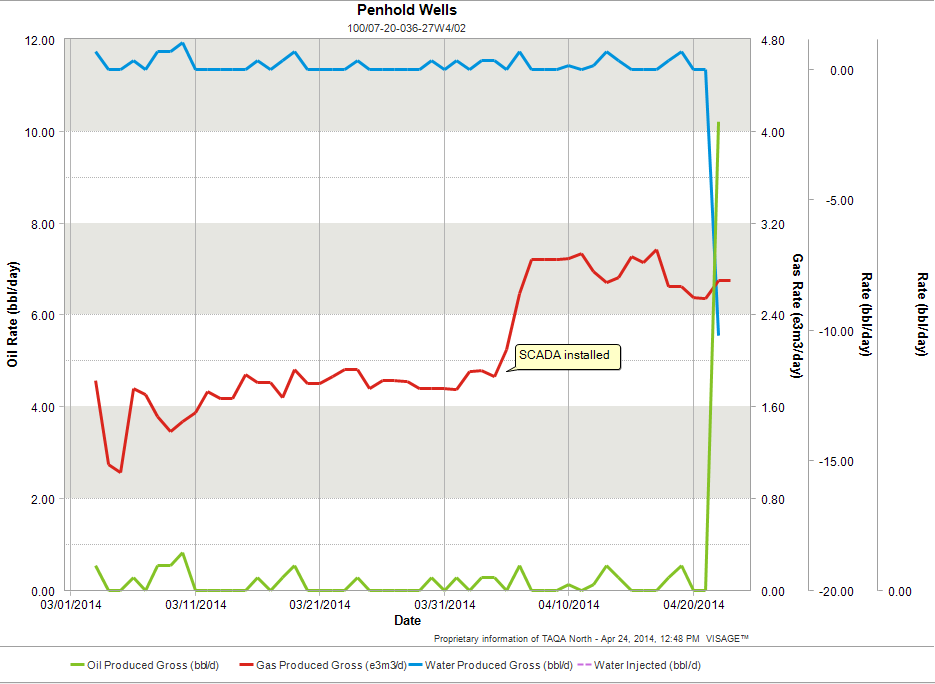

The next well to optimize was well 07-20-036-27W4M. The plunger was installed in June 2010. As presented in figure 11, the increase in the gas volume from the sustained 2 to 2.8 and then to 3e3m3/day is evident. However, the production was slightly reducing as time goes. The amount of oil and water remained stable. The installation of the SCADA system in the well took place on April 3 rd 2010 with appropriate adjustment setting the optimization right in order to have adequate time.

In this trial, the cycles periods were set based on the previous set of the chart setting. Consequently, it has 21 flowing hours per day due to a single shut in hours and seven flowing hours in each cycle. The plunger has therefore made it to the surface successfully. This means that there is enough loaded bottom hovel pressure produced in one hour shut in period with a proportional static and differential pressure in the flow rate represented in figure 12 throughout the whole period.

By looking at the focused production graph for the last two months in figure 13, the tremendous increase is evident through conversion to SCADA. The gas rate has a sustained increase of approximately 1e3m3/day (from 1.8e3m3/day to 2.8e3m3/day). Yet, the rates of oil and water remain constant. There may be more optimization by testing the reduction of the shut in time for less than one hour before check if it is the best time for the pressure to build up. Though, this is the accomplishment expected for the residual 28 plunger wells.

Finally, the third examined well was 10-29-36-27W4M. Going over the production history, it is clear that there is a dramatic jump of the gas flow rate in July 2013 caused by the plunger installation. In fact, the rate rose from 1e3m3/day to 5e3m3/day. Prior to that, the well was put into a swabbing program that did not work properly hence forcing it to be replaced by the plunger. Unfortunately, access to the clear SCADA in this well is not ready hitherto. The same estimation would apply for the 1e3m3/day uplift by SCADA. Even after the loss has been controlled, the final revenue might not be changed due to other reasons like the prorated factor of the SCADA production. Other factors like production by chart, allocation of all wells to one measuring station, and partnership of facilities or production of wells as shared between various companies. In this context, all the three wells operations belong to the TAQA NORTH Company. Thus, any increase in the volume would have a direct impact on the revenues.

There was an expected cost reduction caused by the conversion. In the case of the Chart system, the operator had to drive to the well every day or every second day. In the SCADA case, there was less operators’ visits (30%) as assumed by the field machinists while 70% of the operators still visited the field from time to time from different grounds of operations for checkups. As a result, there was less access clearing from tilling the lease roads or doing some maintenance due to the effects of winter weather in Alberta. There could be cost savings by eliminating the costs of the weekly chart alteration as well as scanning and sending the charts. Hence, the operators’ estimation of the main costs and roads maintenance reduction was 50%. The other half of the cost resulted from different site trips meant for different purposes. The costs were estimated due to an allocation of expenses to every individual well.

For the three wells, savings were taken for the last three years for more accuracy and to distinguish any irregular figure. Nevertheless, all the years spent were quite lower than what was expected as they fall within the convenience range. The average savings taken from the three years in a row showed a slight difference in each year due to several reasons. Among the reasons include the yearly weather effects that affected the maintenance costs, expenditure, or the budget allocated in that specific year.

For well 4-11-37-27W4, the average savings per year was $ 1307.20. This was not a very extraordinary saving given the aforementioned reasons as demonstrated in table 1. The costs of labor along with roads and maintenance are higher as compared to well 10-29-36-27W4.

Table 1: Costs and Savings for well 4-11.

For well 10-29-36-27W4, the average reduced cost was $874.20 per year as shown in the summary of table 2. The well is considered to have less visiting costs compared to the other two wells. That might be the reason for the close distance between the operator office and the site. The table clearly illustrates the yearly costs ranging from labor as well as roads and maintenance to help the Company determine the total savings.

Table 2: Costs and Savings for well 10-29.

Basically, well 7-20-36-27W4 has a higher cost reduction based on the opposite reason compared to the previous wells that saved higher labor costs. Thus, the well has the highest savings per year which is $ 1537.83 as elaborate in table 3.

Table 3: Costs and savings for well 7-20.

Economic Justification

In relation to the economics of the project, the first factor to look at is the capital cost of the SCADA system machine installation. The cost is at $5000 devoid of the RTU (remote terminal unit) equipment. Yet, the cost ranges to $10,000 with the RTU equipment in place. This takes into account the annual operations and wireless connection fees that remain very small along with the maintenance costs. As a result, there is a safe estimated margin by the operators that the cost could not exceed $5000 mark. This would make the total capital cost of the installation to be $15,000 in each well. In addition, the expected production rise over the coming five years might be 1e3m3/day (thousand standard cubic meters per day) that equals 35.5mcf/day (thousand standard cubic feet per day). The estimation is in terms of the savings as most of the wells are located far from the operator’s office. Thus, the average reduction cost for each well per year is equal to $1500.

In regard to the previous values and assumptions, a peep case that is software was run for the economic aspect of all the oil and gas projects. In order to run the case, two sequential cases had to be created. The first case was a base case where all the assumptions were stated. The other case was where the volume of uplift effect was added to the basic one. After that, a consolidation run showed up the results. The net present value of the project was $126000 for each well. The value was believed to be a positive value. The ten percent discounting productivity index was 8.4 more than 0.3 that the company’s policy requires. Since this project was considered to be a small project, the payback standards target was six months or less. This included a payback period of 4.5 months that was consistent with the policy of the entire project. The summary of economic indicators for the successful project is demonstrated in table 4. Hence, it is possible for the project assistants to estimate their financial projections for the remaining wells.

Table 4: Economics summary.

Other SCADA benefits

Apart from the quantified parts of the project, there are other advantages of SCADA that can be shown in the long term. As was presented before, SCADA is known to let the operator do all the measurement and setting of the optimization through offices other than visiting each site. The factor allows the operators to deal with more plunger wells in the shortest time possible. As a result, there is less waste of operator’s time that can be invested in other field operations, follow up, and base management optimization. SCADA has the specialty for monitoring the plunger velocity that permits the operator to adjust to the arrival time of the plunger to the surface based on the velocity. That is a very important aspect for increasing the safety and performance. Equally, the property guarantees the plunger lifts that have high friction with tube wall that can sabotage it, those that can get damaged, or ones that cannot reach the wellhead at the stipulated time. Subsequently, this provides for a longer equipment life besides reducing the maintenance costs.

Regulations

There was a recent regulation launched by the government of Alberta that requires any corporation to have an EFM method for any well that involves an artificial left tool such as the plunger lift. The justification for the SCADA installation project shows that it is a beneficial alternative for the oil and gas companies. Supposed the economic justification showed us negative results, an exemption request for perseverance using the chart system for a longer time would be a valid solution. Interestingly, this would force the Alberta energy regulator (AER) back and provide them with evidences that this is a non-profitable and non-effective transfer for the company. The other exceptions had already been offered by the AER. These comprised of the utilization of individual batteries for shorter time chart periods in the wells that would cost more time and money.

In conclusion, it is elaborate that before the conversion to SCADA the system optimizes the plunger lift mechanism. This owes to the fact that it allows the company to raise the volume of production by 1e3m3/day over the looming years by reaching the appropriate setting. Similarly, the aspect enables the company to save an average of 1500 in each plunger well in every financial year. As stipulated in the economics, the success of the project is in the short term while recognizing the long-term benefits. Therefore, it becomes easy to believe that conversion of the measurement system is justified and the regulations are properly met.

Several recommendations are made as established on the site visits made, data observed and analyzed, as well as the economics results. It is thus recommended to spend funds in converting the entire 28-plunger wells measurement from chart to SCADA in Penhold area. Likewise, converting the other TAQA NORTH plunger wells in other areas apart from Penhold should be considered. Besides, it is important to provide more studies of SCADA setting optimization effect on different well types (oil or gas). Ultimately, the company must try and quantify the other benefits of SCADA and put them in accurate figures for better justifications.

Dan, P., Lynn, R., & Gordon, G. (2005). Plungers lift optimization and troubleshooting. Denver, Colorado: Gas Well De-Liquification workshop.

Dennison, R. (2013). SCADA system assessment . Maple Grove, MN: EPG Companies Inc.

McManus, B. (2013). Directive 017: Measurement requirements for oil and gas operations . Calgary, Alberta: Alberta Energy Regulator.

MTRAC (n.d). Optimal plunger lift operation: Intelligent, self-adjusting wellhead management system . Web.

- Cement Industry in Kuwait and SWOT Analysis for Kuwait Cement Industry

- Car Preferences for Dubai Car Users

- Wells Fargo: Financial Position

- Olympic-Style Lifts and Power Lifting Lifts

- Wells Fargo Fake Account Incident

- Risk Management for Bar Industry

- Saudi Developers in Smartphone Applications

- Productivity Improvement in Industries

- Mining Investment in Mongolia's Energy Sector

- Financial Performance of Saudi Cement Sector

- Chicago (A-D)

- Chicago (N-B)

IvyPanda. (2022, April 5). Oil and Gas Industry: Extensive View. https://ivypanda.com/essays/oil-and-gas-industry-extensive-view/

"Oil and Gas Industry: Extensive View." IvyPanda , 5 Apr. 2022, ivypanda.com/essays/oil-and-gas-industry-extensive-view/.

IvyPanda . (2022) 'Oil and Gas Industry: Extensive View'. 5 April.

IvyPanda . 2022. "Oil and Gas Industry: Extensive View." April 5, 2022. https://ivypanda.com/essays/oil-and-gas-industry-extensive-view/.

1. IvyPanda . "Oil and Gas Industry: Extensive View." April 5, 2022. https://ivypanda.com/essays/oil-and-gas-industry-extensive-view/.

Bibliography

IvyPanda . "Oil and Gas Industry: Extensive View." April 5, 2022. https://ivypanda.com/essays/oil-and-gas-industry-extensive-view/.

- To find inspiration for your paper and overcome writer’s block

- As a source of information (ensure proper referencing)

- As a template for you assignment

- Search Search Please fill out this field.

About Hydrocarbons

Upstream, midstream, downstream.

- Oil Production Numbers

- Gas Production Numbers

The Bottom Line

- Commodities

How the Oil and Gas Industry Works

:max_bytes(150000):strip_icc():format(webp)/investopedia_headshot__rebecca_mcclay-5bfc262446e0fb0083bf8308.png)

- Guide to Investing in Oil Markets

- How to Invest in Oil

- Making a Profit in Crude Oil

- Risks of Oil Investing

- How the Oil Industry Works CURRENT ARTICLE

- Effect of Crude Inventories

- How to Buy Oil Options

- Understanding Oil Firms

- What Determines Oil Prices?

- Factors That Affect the Price of Oil

- OPEC vs. the US

- OPEC's Influence on Global Oil Prices

- Oil and Natural Gas Prices Correlation

- Oil Prices and Inflation

- Oil Prices and the US Economy

- United States Oil Fund

- Oil Prices and the Stock Market

- Economic Indicators for Oil Investors

- Especially Important Economic Indicators

Daniel Balakov / Getty Images

The oil and gas industry is one of the largest sectors in the world in terms of dollar value, generating an estimated $4.2 trillion in global revenue as of late 2024. Oil is crucial to the global economic framework, impacting everything from transportation to heating and electricity to industrial production and manufacturing.

Investors looking to enter the oil and gas industry can quickly be overwhelmed by the complex jargon and unique metrics used throughout the sector. This introduction is designed to help anyone understand the fundamentals of companies involved in the oil and gas sector by explaining key concepts and the standards of measurement.

Key Takeaways

- The oil and gas industry is broken down into three segments: upstream, midstream, and downstream.

- Upstream, or exploration and production (E&P) companies, find reservoirs and drill oil and gas wells.

- Midstream companies are responsible for transportation from the wells to refineries.

- Downstream companies are responsible for refining and the sale of the finished products.

- Drilling companies contract their services to E&P companies to extract oil and gas.

- Well-servicing companies conduct related construction and maintenance activities on well sites.

Hydrocarbons make up crude oil and natural gas, which are naturally occurring substances found in rock in the earth's crust. These organic raw materials are created by the compression of the remains of plants and animals in sedimentary rocks such as sandstone, limestone, and shale.

The sedimentary rock itself is a product of deposits in ancient oceans and other bodies of water. As layers of sediment were deposited on the ocean floor, the decaying remains of plants and animals were integrated into the forming rock. The organic material eventually transforms into oil and gas after being exposed to specific temperatures and pressure ranges deep within the earth's crust.

Oil and gas are less dense than water, so they migrate through porous sedimentary rock toward the earth's surface. When the hydrocarbons are trapped beneath less-porous cap rock, an oil and gas reservoir is formed. These reservoirs of oil and gas represent our sources of crude oil and natural gas.

Hydrocarbons are brought to the surface by drilling through the cap rock and into the reservoir. Once the drill bit reaches the reservoir, a productive oil or gas well can be constructed and the hydrocarbons can be pumped to the surface. When the drilling activity does not find commercially viable quantities of hydrocarbons, the well is classified as a dry hole , which is typically plugged and abandoned.

Hydrocarbons trapped in rock formations such as oil shale can be extracted by injecting high-pressure fluid into the ground and fracturing the rock, a process known as " fracking ."

The oil and gas industry is broken down into three main segments: upstream, midstream, and downstream.

Upstream businesses consist of companies involved in the exploration and production of oil and gas. These are the firms that search the world for reservoirs of the raw materials and then drill to extract that material. These companies are often known as "E&P" for " exploration and production ."

The upstream segment is characterized by high risks, high investment capital, and extended duration as it takes time to locate and drill, as well as being technologically intensive. Virtually all cash flow and income statement line items of E&P companies are directly related to oil and gas production.

E&P companies do not usually own their own drilling equipment or employ a drilling rig staff. Instead, they hire contract drilling companies to drill wells for them and the contract drilling companies generally charge for their services based on the amount of time they work for an E&P company.

Drillers do not generate revenue that is tied directly to oil and gas production, as is the case for E&P companies. Once a well is drilled, various activities are involved in generating and maintaining its production over time. These activities are called well servicing and can include logging, cementing, casing, perforating, fracturing, and maintenance. Oil drilling and oil servicing thus represent two different business activities within the oil and gas industry.

E&P companies are often valued by their oil and gas reserves; these untapped resources are the key to their future earnings.

Midstream businesses are those that are focused on transportation. They are the ones responsible for moving the extracted raw materials to refineries to process the oil and gas. Midstream companies are characterized by shipping, trucking, pipelines, and storing raw materials.

The midstream segment is also marked by high regulation , particularly on pipeline transmission, and low capital risk. The segment is also naturally dependent on the success of upstream firms.

Downstream businesses are the refineries and gas stations. Refineries are the companies responsible for removing impurities and converting the oil and gas to products for the general public, such as gasoline, jet fuel, heating oil, and asphalt. Gas stations are where consumers fuel up at the pump.

Understanding Oil Production Numbers

E&P companies measure oil production in barrels. One barrel, usually abbreviated as bbl, is equal to 42 U.S. gallons. Companies often describe production in terms of bbl per day or bbl per quarter.

A common methodology in the oil patch is to use a prefix of "M" to indicate 1,000 and a prefix of "MM" to indicate 1 million. Therefore, 1,000 barrels are commonly denoted as Mbbl, and 1 million barrels are denoted as MMbbl. For example, when an E&P company reports production of seven Mbbl per day, it means 7,000 barrels of oil per day.

As is the case for drilling, many public companies are involved in well service activity. The revenue of service companies is tied to the activity level in the oil and gas industry. Rig count and utilization rates are indicators of the amount of activity happening in the United States at any given time.

Understanding Gas Production Numbers

Natural gas production is described in terms of cubic feet. Similar to the convention for oil, the term Mmcf means 1 million cubic feet of gas. Bcf means 1 billion cubic feet, and Tcf represents 1 trillion cubic feet.

Note that natural gas futures trade on the CME Group futures exchange but are not measured in cubic feet. Instead, the futures contract is based on 1 million British thermal units, or MMBtu, which is roughly equivalent to 1,000 cubic feet of gas.

E&P companies often describe their production in units of barrels of oil equivalent (BOE) . To calculate BOE, companies usually convert gas production into oil equivalent production. One BOE has the energy equivalent of 6,000 cubic feet of gas or roughly one bbl to six Mcf.

Oil quantity can be similarly converted into gas quantity, and gas producers often refer to production in terms of gas equivalency using the term Mcfe.

E&P companies report their oil and natural gas reserves—the quantity of oil and gas they own that is still in the ground—in the same bbl and mcf terms. Reserves are often used to value E&P companies and make predictions for their revenue and earnings. Public oil and gas companies are required to disclose proven oil and gas reserve quantities as supplementary information but not as part of their financial statement .

Of course, new reserves are an essential source of future revenue, so E&P companies spend a lot of time and money exploring new untapped reservoirs. If an E&P company stops exploring, it will have only a finite amount of reserves and a depleting quantity of oil and gas. Revenue will inevitably decline over time. In short, E&P companies can only maintain or grow revenue by acquiring or finding new reserves.

What Is an Integrated Oil Company?

An integrated oil company is involved in two or more of the stages of oil production (e.g., both upstream and downstream). Many of the world's largest and most influential oil companies today are integrated oil and gas companies, which have separate divisions for each stage. Being an integrated company allows for complete control and improved efficiency. It also provides for various streams of revenue and diversification. However, due to the very high capital costs involved with oil exploration and refining, barriers to entry are very high for new competitors.

Which Countries Produce the Most Oil and Gas?

As of 2024, the United States is the world's largest net producer of crude oil, followed by Saudi Arabia, Russia, Canada, and China. When it comes to natural gas production, the top five countries include the United States, Russia, Iran, China, and Canada .

What Are the 3 Ps of Oil Reserves?

Reserves refer to crude oil or natural gas deposits that remain underground and have not yet been extracted. The three "P"s of reserves refer to " proven ," " probable ," and " possible ." These correspond with the likelihood of successfully drilling in those deposits. The oil and gas industry gives proven reserves a 90% certainty of being produced (also known as P90). The industry gives probable reserves a 50% certainty (P50), and possible reserves just a 10% certainty (P10) of actually being produced.

What College Degree is Needed to Work in the Oil and Gas Industry?

The oil and gas industry requires the work of many individuals with degrees . Degree fields include petroleum, mechanical, and chemical engineering, and petroleum geology. Companies also hire graduates with specialties in mathematics, physics, and civil engineering.

The oil and gas industry is vital to the global economy, influencing transportation, electricity, and manufacturing. It comprises three main segments: upstream (exploration and production), midstream (transportation to refineries), and downstream (refining and selling products like gasoline).

Production is measured in barrels for oil and cubic feet for natural gas, with reserves being important for company valuation. Integrated oil companies operate across all of these three segments and the largest producing countries are the United States, Saudi Arabia, and Russia.

IBISWorld. " Global Oil & Gas Exploration & Production Industry - Market Research Report ."

U.S. Energy Information Administration. " Units and Calculators Explained ."

Petroleum Office. " Unit Converter: Volume Flow Rate ."

CME Group. " Henry Hub Natural Gas Futures - Contract Specs ."

T.R. Klett. " Chapter 27: Conversion Factors (Approximate) ," Page 1. Petroleum Systems and Geologic Assessment of Oil and Gas in the Southwestern Wyoming Province, Wyoming, Colorado, and Utah By USGS Southwestern Wyoming Province Assessment Team . U.S. Geological Survey Digital Data Series DDS–69–D, 2005.

Financial Accounting Standards Board. " Summary of Statement No. 69 ."

U.S. Energy Information Administration. " What Countries are the Top Producers and Consumers of Oil? "

The CIA World Factbook. " Field Listing: Natural Gas ."

:max_bytes(150000):strip_icc():format(webp)/4-benefits-of-rising-oil-prices-5bfc2df546e0fb0083c0e7af.jpg)

- Terms of Service

- Editorial Policy

- Privacy Policy

- Your Privacy Choices

Home — Essay Samples — Business — Leadership — Effective Operations Management in the Oil and Gas Industry: Strategies for Success

Effective Operations Management in The Oil and Gas Industry: Strategies for Success

- Categories: Leadership Quality Management Supply Chain Management

About this sample

Words: 762 |

Published: Dec 16, 2024

Words: 762 | Pages: 2 | 4 min read

Table of contents

The unique challenges of the oil and gas industry, efficiency through technology, sustainability matters, the human element, the role of supply chain management, the future ahead.

- Chisholm K., & Palmer J., (2021). Operations Management in Oil & Gas Industry: Challenges & Solutions." Journal Of Energy Resources Technology 143(9).

- Meyer R., (2020). "Technology's Role In Improving Efficiency In Oil And Gas." Energy Economics 102.(5).

- Petersen M.J., et al., (2019). "Sustainability Practices Within The Oil & Gas Sector." Journal Of Cleaner Production 239(8).

- Taleb A.B., & Bhandari D.D., (2023). "Human Resource Management Strategies In High-Risk Industries: A Case Study On Oil And Gas." International Journal Of Human Resource Studies 13(1).

Cite this Essay

To export a reference to this article please select a referencing style below:

Let us write you an essay from scratch

- 450+ experts on 30 subjects ready to help

- Custom essay delivered in as few as 3 hours

Get high-quality help

Verified writer

- Expert in: Business

+ 120 experts online

By clicking “Check Writers’ Offers”, you agree to our terms of service and privacy policy . We’ll occasionally send you promo and account related email

No need to pay just yet!

Related Essays

5 pages / 2371 words

1 pages / 538 words

6 pages / 3643 words

4 pages / 1927 words

Remember! This is just a sample.

You can get your custom paper by one of our expert writers.

121 writers online

Still can’t find what you need?

Browse our vast selection of original essay samples, each expertly formatted and styled

Related Essays on Leadership

What I took away from this week from Module 6 and Scenario E was that ethics is about making the best possible decision for people, resources and the environment. When we make ethical choices we remove the risks, advance [...]

Servant leadership is an effective leadership approach that can thrive in diverse contexts. This essay will explore the principles of servant leadership, its application in a globalized world, multicultural environments, and [...]

Student ambassador programs are not only instrumental in promoting educational institutions but also serve as fertile ground for personal growth and development. These programs provide students with opportunities to develop [...]

Dayton, D. (2021). The importance of leadership training in the army. Chron. Web.Moldoveanu, M., & Narayandas, D. (2019). The future of leadership development. Harvard Business Review, 97(2), 40-48.

Introduction:Transformational leadership is a concept that has gained significant attention in recent years. It refers to a leadership style characterized by the ability to inspire and motivate followers to achieve [...]

Who is more capable as a leader male or female? This debate itself has been looming since the time management came into effect. But things differ in the way both genders approach the leadership work. One is straightforward while [...]

Related Topics

By clicking “Send”, you agree to our Terms of service and Privacy statement . We will occasionally send you account related emails.

Where do you want us to send this sample?

By clicking “Continue”, you agree to our terms of service and privacy policy.

Be careful. This essay is not unique

This essay was donated by a student and is likely to have been used and submitted before

Download this Sample

Free samples may contain mistakes and not unique parts

Sorry, we could not paraphrase this essay. Our professional writers can rewrite it and get you a unique paper.

Please check your inbox.

We can write you a custom essay that will follow your exact instructions and meet the deadlines. Let's fix your grades together!

Get Your Personalized Essay in 3 Hours or Less!

We use cookies to personalyze your web-site experience. By continuing we’ll assume you board with our cookie policy .

- Instructions Followed To The Letter

- Deadlines Met At Every Stage

- Unique And Plagiarism Free

IMAGES

COMMENTS

The global oil and gas industry exhibited a volatile performance over the past five years (2008-2013), largely driven by the global economic slowdown and subsequent recovery. Although tensions in the Middle East and increasing difficulty In the extraction process threaten to hinder growth over the next five years, however greater economic ...

Essay Sample: Oil industry is a very complicated industry. Oil is very valuable and needed in every aspect of life. The world economy depends on entirely. ... Inken. (2010). The Global Oil and Gas Industry. Bridge-Le Billion.(2012). Oil Capture. Flatau, J. (2007). Supply chain analysis of olive oil in Germany. Giessen: ZEU.

Oil and gas is one of the most critical industries in the world and is a significant economic driver in the UAE. Oil is the world's most important energy source, accounting for nearly two-thirds of global energy consumption. It is used in various applications, including transportation, industry, and manufacturing. Gas is also an essential energy […]

Business. This paper is aimed at analyzing the global energy industry with a focus on oil and gas segment using a Porter Five Forces framework. The oil and gas industry has many subsegments and a variety of products, but some level of generalization can be applied to describe the market within this framework.

The oil and gas industry is a very broad industry where many different sectors and engineers complement one another in order to deliver the most efficient performance. By referring to the performance, it means the operation system tracked by the production capacity of the company.

Oil And Gas Essay. Sort By: Page 1 of 50 - About 500 essays. Better Essays. Oil, Oil And Gas. 3001 Words; 13 Pages; Oil, Oil And Gas ... The oil and gas industry happens to be the largest industry in the world as it is the singular point of growth for a civilisation. Its importance lies in the fact that it is a fundamental aspect involving ...

Disclaimer: This essay is provided as an example of work produced by students studying towards a commerce degree, it is not illustrative of the work produced by our in-house experts.Click here for sample essays written by our professional writers.. Any opinions, findings, conclusions or recommendations expressed in this material are those of the authors and do not necessarily reflect the views ...

This Oil and Gas industry contribute significantly to the economy. The rationale based on this industry choice is to gain an insight to how prepared companies are regarding the risk posed by climate change. According to a report by Palma (200*) she explored increasing pressure in the Oil and Gas industry face from climate change.

The oil and gas industry gives proven reserves a 90% certainty of being produced (also known as P90). The industry gives probable reserves a 50% certainty (P50), and possible reserves just a 10% ...

Operations management in the oil and gas industry is a fascinating subject that sits at the crossroads of technology, economics, and environmental... read full [Essay Sample] for free search Essay Samples